PROTECT SYSTEM SUSTAINABILITYEnsuring we provide services and benefits that are fair, accessible, transparent and fiscally responsible. |

We are dedicated to building a strong, stable, and sustainable workers’ compensation system that serves New Brunswick’s workers and employers today and in the years to come. We diligently work to avoid an unfunded liability to ensure worker benefits are protected and employer assessment rates are stable and competitive with other provinces.

Fortunately, with new legislation implemented in late 2018, we are better positioned to decrease our costs and align with other Canadian jurisdictions without impacting benefits for an at-work injury.

These legislative changes were also positive news for New Brunswick’s workers. Over 25 years ago, an unpaid waiting period was introduced whereby an employee who suffered a work-related injury was not eligible for compensation for the first three days of the claim. The new legislation repeals that provision in stages, with the initial elimination of one unpaid day effective July 1, 2019 and the complete elimination of the unpaid waiting period by July 1, 2021.

Responding to new legislation, staff initiated significant policy revisions in 2018 that will enable a better balanced system, with a clear focus on supporting injuries that are work-related, including occupational hearing loss.

Implementing the remaining recommendations put forward in the Ministerial Task Force report and by the Auditor General should further contribute to our ability to better manage the cost trends.

In 2018, we started looking at our rate-setting process to see how we can improve our current model to further support safe work practices and encourage a better understanding of the rate components, its impact and how each component is managed. Additionally, we will continue our stakeholder sessions, which have been helpful in sharing this information as well as developing an understanding of the workers’ compensation system.

We are also looking at all our internal processes for efficiencies and cost savings. In 2018, we started investing in upgrades that resulted in efficiencies in productivity and performance, and these will continue in the following years.

We also focused on reducing risks related to overpayments. Being able to effectively identify, track and action on overpayments within the two-year statute is important. In 2018, we assigned a special team to review the processes and identify a new recovery plan to ensure that we action overpayments early and collect them quickly.

COST DRIVERS

BENEFIT COSTS AND REVENUE – SELF-INSURED EMPLOYERS (MOSTLY PUBLIC SECTOR)

Self-insured employers, primarily government, are not assessed employers. They pay the actual cost of compensation paid to their workers as well as for medical and rehabilitation costs. They also pay an administration fee.

WorkSafeNB is working with self-insured employers to protect workers, better encourage return to work practices and minimize this cost pressure.

BENEFIT COSTS AND REVENUE – ASSESSED EMPLOYERS (MOSTLY PRIVATE SECTOR)

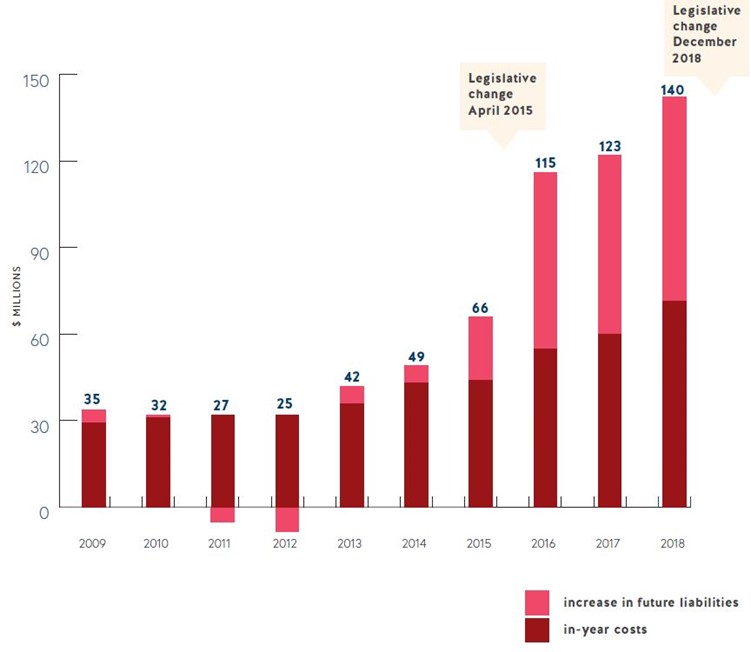

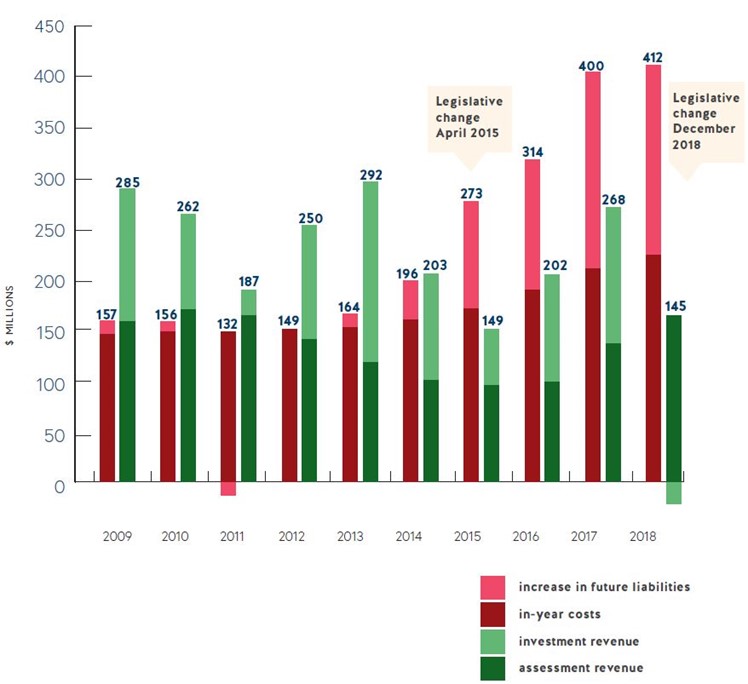

The chart below demonstrates the fluctuations in costs versus revenue in the last decade. While revenue outpaced costs from 2009-2014 by $338 million, in 2015 our costs quickly outmatched both the revenue from premiums as well as our investment revenue leading us to have expenses exceed income by $635 million.

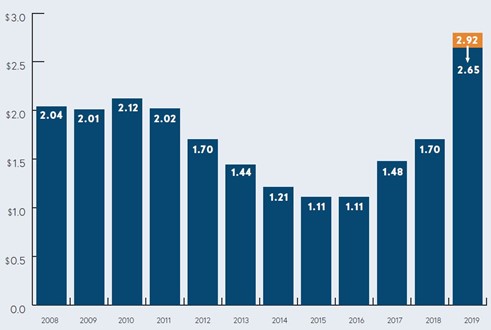

ASSESSMENT RATES

Despite the cost increases starting in 2015, our high return on investments allowed us to offset the increasing costs while claim costs began to rise. Due to legislative amendments in late 2018, we were able to reduce the 2019 average assessment rate from $2.92 to $2.65.

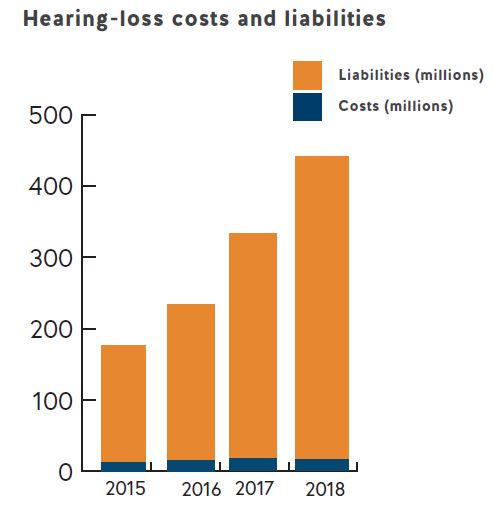

HEARING LOSS

In 2018, we spent, on average, $1 million per month in hearing-loss claims alone. By the end of the year, hearing loss claims represented $424 million in liabilities. New Brunswick has a three to four times higher claim rate than other Canadian jurisdictions. Legislative amendments in December 2018 will position WorkSafeNB to better manage hearing-loss related costs by ensuring that benefits are provided only for noise-induced hearing losses incurred in the course of employment.

The number of hearing-loss claims in New Brunswick has been rising dramatically in the past decade. For example, in 2010 we accepted 822 hearing-loss claims whereas in 2018, we accepted 2,312 hearing-loss claims.

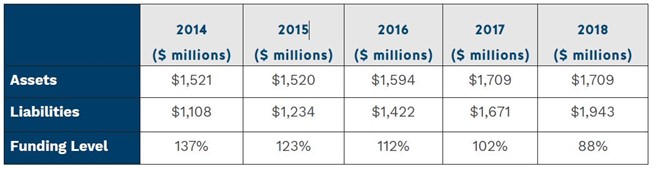

FUNDING LEVEL

Our management of the funds collected from employers and our investments is key to safeguarding the future of the workers’ compensation system.

Between 2014 and 2018, while our liabilities increased by $800 million, due to strong investment performance, and an increase in rates, our assets increased by $200 million. As a result, our funding position decreased by $600 million (rather than $800 million) by 2018.

We expect recent changes to legislation and internal process improvements to improve our balance sheet in 2019 onward.

INVESTMENT PERFORMANCE

Despite significant market fluctuations over the last 10 years, our overall accident fund’s performance continues to meet and exceed our expectations. In 2018, as the market experienced a downturn in the last quarter, our accident fund returned (1.32%).

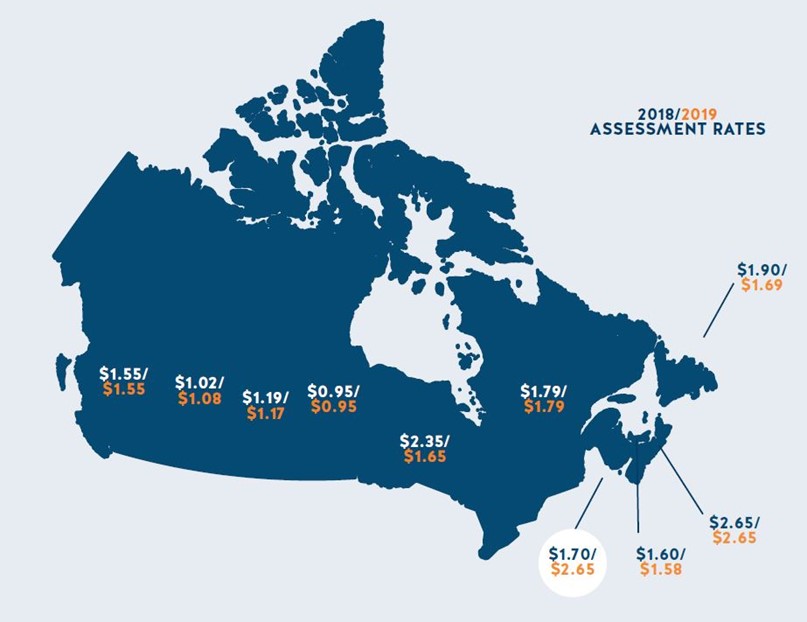

ASSESSMENT RATES ACROSS CANADA

While assessment rates are commonly viewed as indicators of a system’s financial health and safety record, they are but one data point among many that tell this story. A jurisdiction can have low assessment rates but still provide generous benefits to workers. For example, Manitoba has a high lost-time injury frequency compared to other provinces, but a low assessment rate. This is mainly a result of a return-to-work culture leading to shorter claim duration and a decrease in claim costs. Ultimately, when there are strong return-to-work outcomes, the system is in a position to offer more generous benefits to injured workers and more value to employers.